Eurora

Building an AI-based IOSS VAT and tax calculation public Shopify app for intelligent cross-border compliance platform

Client

Our client is a European company with headquarters located in Tallinn, Estonia, which provides all the services on one platform for managing secure cross-border trade. Such top-notch technology allows managing large amounts of data and VAT processing saving time on compliance and tax procedures, and fills electronic declarations and item descriptions quickly. Its AI-based algorithm greatly simplifies the whole process of e-commerce and helps entrepreneurs to sell goods seamlessly across EU and UK markets.

It is an indispensable service for businesses in the European Union to manage the complexity and risk of their accounting compliance obligations and reduce the stress of complex taxation systems applied differently in each EU country.

Business needs

In our joint project, we needed to connect the company's system and partnering Shopify stores. To achieve it, we offered to create an app that would serve as a link between shop owners and buyers. While shop owners can easily supervise duty & tax calculations with a completely automated process handled by an artificial intelligence system, buyers get a user-friendly interface for online shopping with calculation of all necessary taxes.

Secondly, we had to integrate Import One Stop Shop (IOSS) processing for Shopify e-commerce stores to collect, declare and pay the VAT to the tax authorities. With this Shopify internationalization service, buyers are exempted from paying VAT when importing goods into the EU, as it used to be. That helps both buyers and shop owners handle tax management challenges for product categories in different EU countries, and reduces administrative burden.

Solution

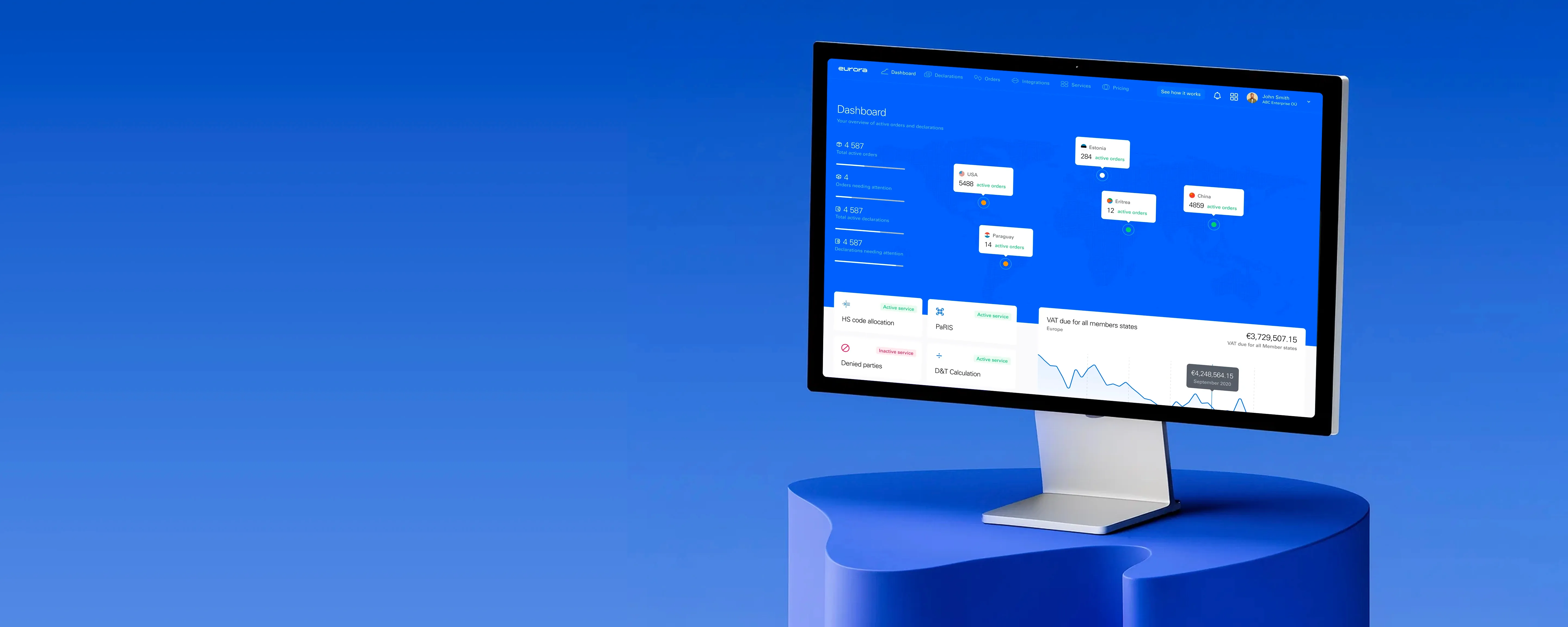

To supervise duty & tax calculations we developed an application to link our client's internal APIs and Shopify stores. Our app helped businesses relieve the burden of tax settlements and satisfy customers with the convenience of online marketplaces. After getting a subscription to the services, the user must register on a portal. That is a signal for the in-store application that the user is confirmed, and the user's APIs can now communicate with the generative AI solution. Thus, while each order is being made, the store APIs will send data to the APIs, and those will automatically calculate all duty and tax charges.

We faced a challenge during development because integrating the internal API into Shopify's tax system was problematic due to Shopify's internal tax settings. We are proud to have successfully handled this task. We used the Carrier Service as a core tool, which allowed us to create our own Shipping Profile and get into the checkout area to display the results of taxation calculations right there. That gave us the ability to show the tax information “on the go”.

Another tricky part was ensuring that taxes were calculated when discounts were applied. A cached system layer was implemented to connect specific checkout with Carrier Service which allowed us to re-calculate taxes even after a discount or coupon code was applied.

Result

Finally, we introduced a complex solution and now we are on the successful MVP release stage. Our system already includes a smooth setup flow. It can exchange tax information with the client services “on the go” and send IOSS declarations automatically. The client received pretty happy customer feedback as they really enjoyed the possibility of just installing one app and then keeping maintenance of their stores. They are impressed by its flexibility and the greater control our new application affords over e-commerce sales.

We implemented in our project a ton of new knowledge, but we enjoyed the challenge, especially when it allows scaling the work of our client to new heights. For now, our engineering team is at the start of launching a second phase of the app where we are going to dive deeper into the edge cases of order processing and look forward to covering them as well.